Trick Tips for Submitting an Online Tax Return in Australia and Avoiding Common Mistakes

Trick Tips for Submitting an Online Tax Return in Australia and Avoiding Common Mistakes

Blog Article

Simplify Your Funds: How to File Your Online Income Tax Return in Australia

Filing your online tax return in Australia need not be a daunting job if come close to methodically. Recognizing the details of the tax obligation system and properly preparing your papers are necessary first steps.

Understanding the Tax System

To browse the Australian tax obligation system properly, it is important to understand its basic concepts and framework. The Australian tax system runs on a self-assessment basis, suggesting taxpayers are accountable for precisely reporting their earnings and computing their tax obligation obligations. The main tax obligation authority, the Australian Taxation Workplace (ATO), oversees conformity and applies tax legislations.

The tax system consists of various parts, consisting of revenue tax obligation, items and services tax (GST), and resources gains tax (CGT), amongst others. Private earnings tax is dynamic, with rates raising as earnings increases, while corporate tax obligation rates vary for large and small businesses. Furthermore, tax offsets and deductions are readily available to reduce taxed earnings, enabling even more customized tax obligation liabilities based on individual scenarios.

Knowledge tax residency is likewise critical, as it figures out a person's tax obligation commitments. Locals are strained on their worldwide revenue, while non-residents are just exhausted on Australian-sourced earnings. Familiarity with these concepts will certainly empower taxpayers to make educated choices, making sure compliance and possibly maximizing their tax results as they prepare to submit their online tax obligation returns.

Preparing Your Records

Collecting the required papers is a critical step in preparing to file your online income tax return in Australia. Correct paperwork not only simplifies the filing procedure yet additionally ensures precision, decreasing the threat of mistakes that might cause charges or hold-ups.

Start by collecting your revenue statements, such as your PAYG settlement summaries from companies, which detail your earnings and tax withheld. online tax return in Australia. Ensure you have your business revenue documents and any kind of pertinent billings if you are freelance. Furthermore, collect financial institution declarations and documents for any kind of passion made

Following, assemble documents of insurance deductible costs. This may include invoices for occupational expenses, such as attires, traveling, and tools, as well as any instructional expenditures connected to your occupation. Ensure you have documents for rental earnings and associated expenditures like fixings or building monitoring charges. if you own building.

Don't neglect to include other pertinent papers, such as your health insurance policy details, superannuation payments, and any kind of financial investment earnings declarations. By thoroughly arranging these papers, you set a solid structure for a smooth and effective on the internet tax return procedure.

Selecting an Online Platform

After organizing your documents, the next action involves picking a suitable online system for filing your tax obligation return. online tax return in Australia. In Australia, several trusted systems are available, each offering one-of-a-kind features customized to different taxpayer requirements

When picking an on the internet system, consider the interface and convenience of navigation. An uncomplicated design can substantially boost your experience, making it simpler to input your details accurately. Furthermore, make certain the platform is compliant with the Australian Tax Workplace (ATO) policies, as this will certainly assure that your submission satisfies all lawful needs.

Another vital variable is the availability of customer support. Platforms using real-time talk, phone support, or extensive FAQs can give valuable assistance if you experience difficulties throughout the declaring procedure. In addition, analyze the security measures in place to safeguard your personal info. Try to find systems that use file encryption and have a strong privacy policy.

Lastly, consider the prices related to numerous systems. While some may offer cost-free solutions for fundamental income tax return, others may bill fees Visit Your URL for advanced attributes or added support. Weigh these variables to pick the platform that aligns ideal with your monetary situation and declaring requirements.

Step-by-Step Filing Procedure

The step-by-step filing procedure for your on-line income tax return in Australia is designed to enhance the submission of your economic info while guaranteeing conformity with ATO guidelines. Begin by collecting all required documents, including your revenue statements, financial institution statements, and any kind of receipts for reductions.

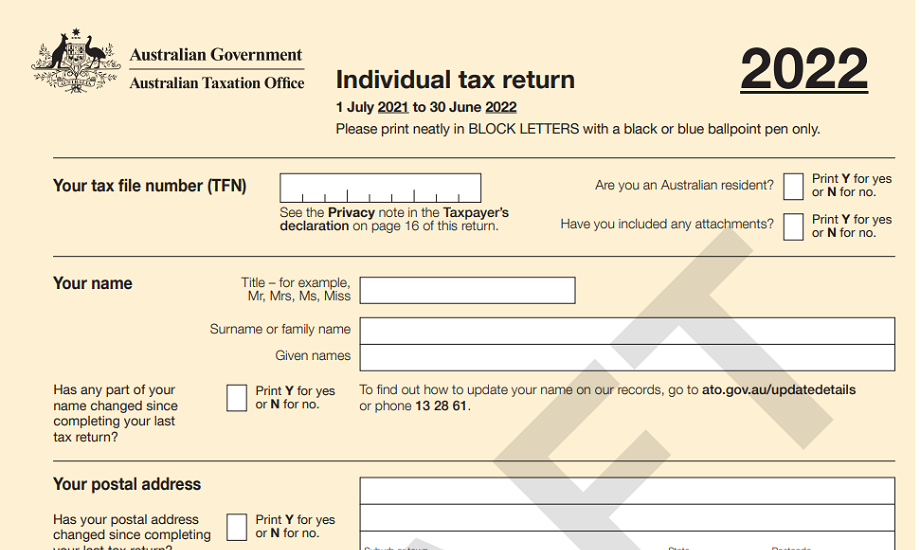

Once you have your records prepared, visit to your selected online system and create or access your account. Input your individual details, including your Tax obligation File Number (TFN) and get in touch with information. Next, enter your revenue details properly, you could try this out guaranteeing to consist of all incomes such as salaries, rental earnings, or financial investment profits.

After describing your income, carry on to claim qualified reductions. This may consist of occupational expenses, philanthropic contributions, and medical expenditures. Make certain to evaluate the ATO standards to maximize your insurance claims.

After ensuring every little thing is correct, send your tax return digitally. Check your account for any kind of updates from the ATO concerning your tax obligation return status.

Tips for a Smooth Experience

Completing your online income tax return can be a simple procedure with the right prep work and frame of mind. To guarantee a smooth experience, begin by collecting all essential files, such as your income declarations, invoices for reductions, and any type of other relevant economic documents. This organization saves and minimizes mistakes time during the filing procedure.

Following, familiarize yourself with the Australian Tax Office (ATO) website and its online solutions. Make use of the ATO's resources, including overviews and FAQs, to clear up any type of uncertainties prior to you start. online tax return in Australia. Consider establishing up a MyGov account linked to the ATO for a streamlined declaring experience

Additionally, benefit from the pre-fill functionality supplied by the ATO, which automatically inhabits several of your details, lowering the opportunity of errors. Ensure you ascertain all access for accuracy prior to submission.

If problems develop, do not hesitate to speak with a tax obligation specialist or utilize the ATO's support services. have a peek at these guys Complying with these pointers can lead to a problem-free and effective on-line tax obligation return experience.

Verdict

To conclude, filing an on the internet income tax return in Australia can be structured via mindful prep work and selection of appropriate resources. By comprehending the tax system, organizing needed records, and picking a certified online system, people can browse the filing process efficiently. Following a structured approach and using offered support guarantees accuracy and maximizes eligible deductions. Inevitably, these techniques contribute to an extra reliable tax obligation filing experience, simplifying financial monitoring and boosting conformity with tax responsibilities.

Report this page